Besepa explained: direct debit automation platform

Do you know what a debit is? What kind of debits are there? We explain everything you need to know in a simple way.

A direct debit is a receipt or invoice that the bank charges to a customer without the customer having to intervene, with their prior authorization.

We can distinguish between two types of direct debits, B2B and CORE. The CORE system is the more traditional direct debit system. The customer has to sign a direct debit order, however, bills can be returned after the direct debit has been passed through the bank.

The B2B system is a system that cannot be used with private individuals, but only with companies or self-employed individuals, and it is essential to have a SEPA B2B order signed by the customer.

Unlike CORE debits, B2B debits cannot be returned by the customer, but they can be returned by the banks in the following cases:

● Technical reasons.

● Lack of liquidity.

Now that we know what a direct debit is and its variants, let’s explain what Besepa, our direct debits management tool, is all about and the advantages of the automation of your direct debits.

How does Besepa work?

Besepa is a very simple and intuitive tool, designed for any business that has recurring accounts receivable. Its objective is to facilitate the work of those who manage fixed receivables on a regular basis, allowing them to forget about creating debit files every day.

This direct debit management tool has a private area in which you can manage your customers, manage your receivables and review both pending and already collected remittances.

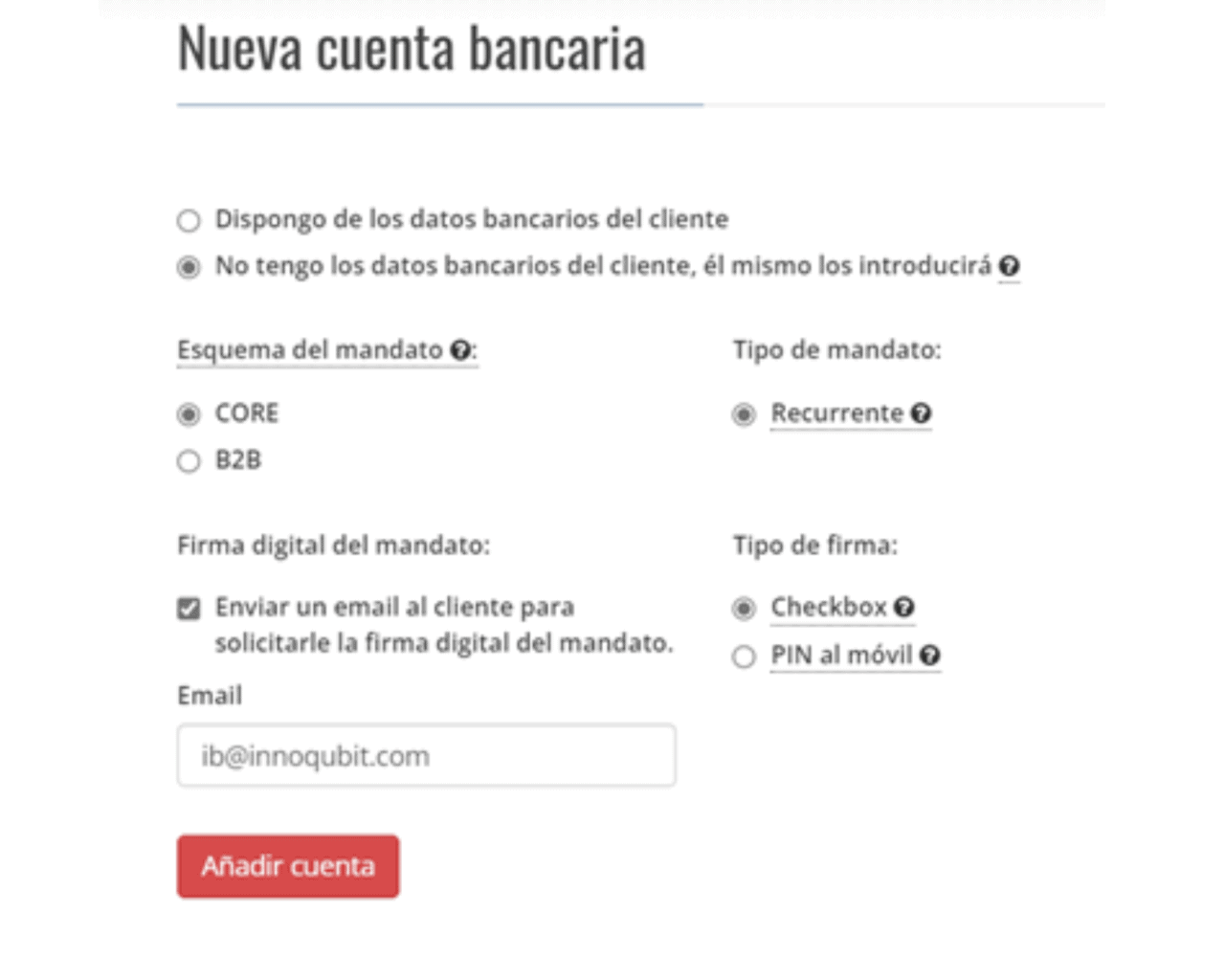

Registering a customer is very simple, you only have to fill in their billing and bank details. You can choose between CORE debit or B2B debit, and even manage the mandate’s digital signature automatically.

To create a debit, you only have to select the customer to whom you want to issue the mandate, fill in the reference data of the mandate, a description and decide when you want to issue it, either as soon as possible or the day you decide.

Moreover, Besepa will informe you in real time about the status of the debits, if they are in process or if they have already been collected.

In case any of your receipts has been rejected, the tool will automatically send 2 notifications, one letting you know the customer that has rejected the receipt and another one to the customer themself. This latter notification will include a URL that will allow the customer to make the payment directly via debit card, avoiding you to contact the customer and reissue the receipt. Consequently, this reduces the management time significantly.

Benefits

● Manage your direct debits under a new common system for the entire SEPA area.

● Issue your direct debits through SEPA CORE or SEPA B2B.

● Be informed in real time.

● Reduce the time spent in creating bill remittances.

● Detect easily possible returns and manage them automatically.

● Comply with all legal and regulatory requirements.

If you have a business and you manage accounts receivables on a recurring basis, this is the tool you were waiting for.